Colby College has announced the creation of the Weiland Welcome Grant through which incoming first-year students in the Class of 2026 and later with an expected parent or guardian contribution of $0 will receive $1,250 in free money in addition to financial aid to address unexpected expenses such as technology needs, course materials, or travel home.

Colby’s generosity to those of relatively modest financial means is being made possible by a three million dollar gift from Trustee Emerita Nancy Weiland ’65 and Andrew Weiland ’64. The newly created endowed fund is an extension of the Colby Commitment, which ensures the most talented students from all backgrounds have access to the best possible education.

Recent changes at Colby have opened doors for more students from all backgrounds to attend the Waterville, Maine liberal arts college, none more so than an increase in the financial aid from twenty-eight million dollars in 2014 to fifty-two million dollars in 2021. Colby is also among a small group of colleges that meets 100 percent of demonstrated need without student loans. Among first-year students in the Class of 2025, eleven percent are projected to be the first in their families to graduate from college, and more than 100 are Pell Grant recipients, triple the number of students receiving Pell Grants from only several of years ago, said Randi L. Arsenault ’09, Colby’s dean of admissions and assistant vice president of admissions and financial aid.

In unrelated, but somewhat ironic news, Colby has also recently announced that it has acquired two private islands in the Gulf of Maine where renowned American artist Andrew Wyeth painted some of his greatest works.

Calls for improving the way students apply for financial aid have been flooding the college admissions world, thanks to two articles by college admissions writer/guru Eric Hoover. The first article goes into painful detail of the painful process (yes, it deserves two painfuls) many students experience

Calls for improving the way students apply for financial aid have been flooding the college admissions world, thanks to two articles by college admissions writer/guru Eric Hoover. The first article goes into painful detail of the painful process (yes, it deserves two painfuls) many students experience

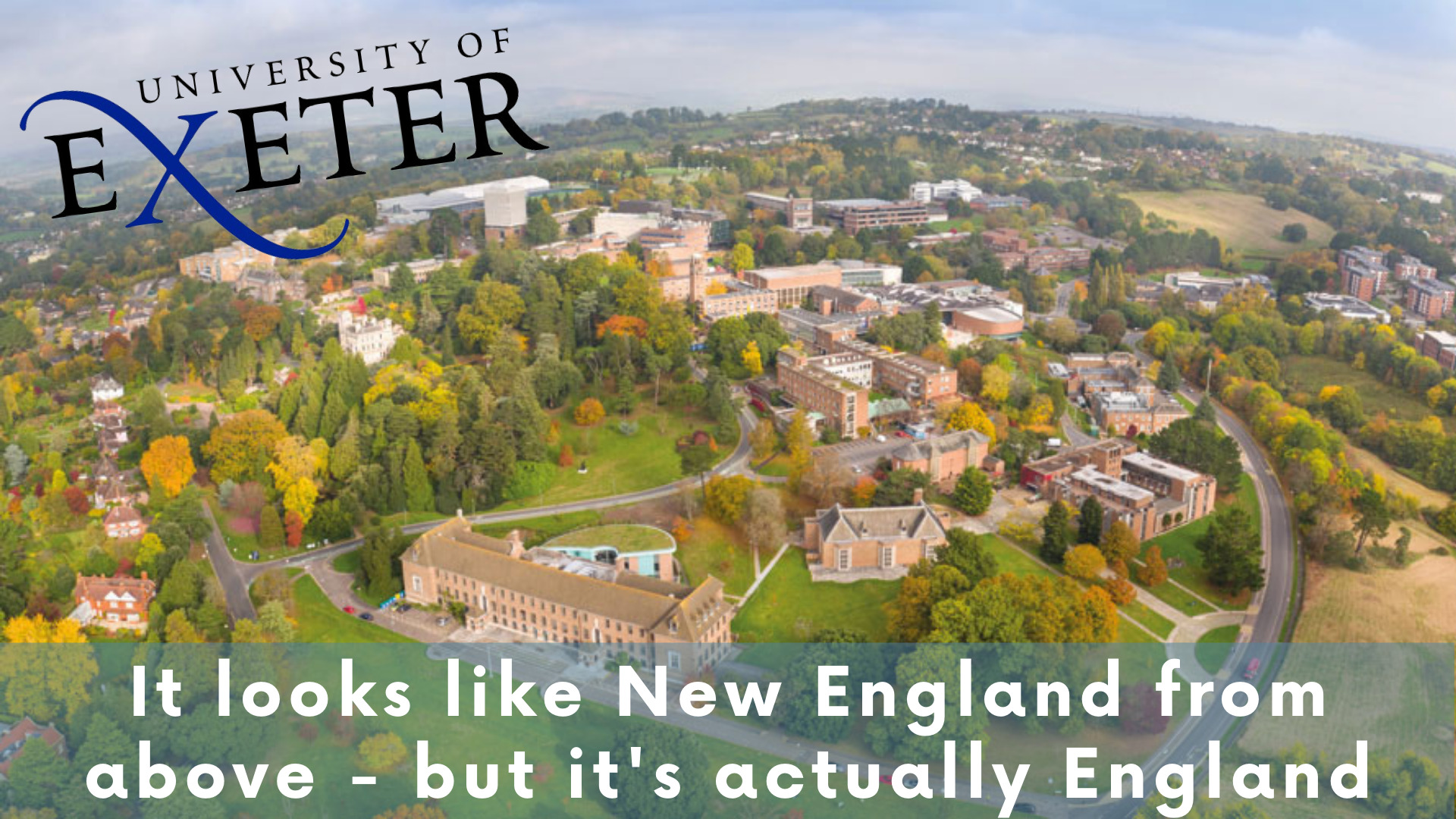

University of Exeter, a member of the Russell Group of research-intensive UK universities, has shared some exciting news for prospective international students: a new scholarship opportunity.

University of Exeter, a member of the Russell Group of research-intensive UK universities, has shared some exciting news for prospective international students: a new scholarship opportunity.

Boston University’s Associate Vice President for Enrollment & Dean of Admissions, Kelly A. Walter, has announced that BU has a new, expanded financial assistance program,

Boston University’s Associate Vice President for Enrollment & Dean of Admissions, Kelly A. Walter, has announced that BU has a new, expanded financial assistance program,